Mrs lopez is enrolled in a cost plan – Mrs. Lopez’s enrollment in a cost plan marks a significant step towards managing her healthcare expenses effectively. This article delves into the intricacies of her cost plan, exploring its purpose, potential advantages, and essential management strategies.

As healthcare costs continue to rise, cost plans have emerged as valuable tools for individuals seeking to control their expenses while accessing necessary medical services. Mrs. Lopez’s decision to enroll in a cost plan reflects a proactive approach to healthcare management.

Cost Plan Overview

A cost plan is a structured payment arrangement between a healthcare provider and a patient. It Artikels the costs associated with specific healthcare services and establishes a payment schedule that aligns with the patient’s financial capabilities. Cost plans are designed to provide greater financial transparency and predictability, enabling patients to better manage their healthcare expenses.

Enrolling in a cost plan offers several benefits, including:

- Predictable Costs:Cost plans provide patients with a clear understanding of the financial obligations associated with their healthcare services, eliminating surprises and financial stress.

- Personalized Payment Schedule:Cost plans are tailored to the patient’s financial situation, ensuring that payments are manageable and do not strain their budget.

- Reduced Financial Burden:By spreading out payments over time, cost plans help reduce the financial burden of healthcare expenses, making it easier for patients to access necessary medical care.

- Improved Communication:Cost plans facilitate clear communication between patients and healthcare providers regarding financial expectations, fostering a stronger patient-provider relationship.

Common types of cost plans include:

- Fixed-Payment Plans:These plans establish a fixed monthly payment amount that covers all eligible healthcare services within a specific period.

- Tiered-Payment Plans:These plans divide healthcare services into tiers, with each tier having a different payment rate. The patient’s payment amount varies depending on the tier of services received.

- Income-Based Plans:These plans adjust payment amounts based on the patient’s income and financial circumstances, ensuring affordability and accessibility.

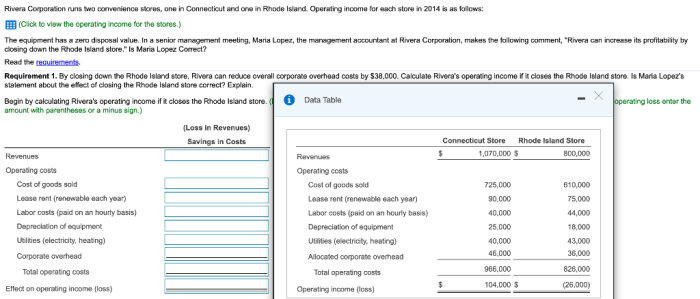

Mrs. Lopez’s Cost Plan Enrollment: Mrs Lopez Is Enrolled In A Cost Plan

Mrs. Lopez is enrolled in a tiered-payment cost plan offered by her healthcare provider. This plan divides healthcare services into three tiers: Basic, Standard, and Premium. Each tier has a different payment rate, with the Basic tier having the lowest rate and the Premium tier having the highest rate.

Several factors may have influenced Mrs. Lopez’s decision to enroll in this cost plan:

- Financial Flexibility:The tiered-payment plan allows Mrs. Lopez to choose the tier that best aligns with her financial capabilities, ensuring that she can access necessary healthcare services without overextending her budget.

- Predictable Costs:The cost plan provides Mrs. Lopez with a clear understanding of her healthcare expenses, allowing her to plan and manage her finances accordingly.

- Improved Communication:The cost plan facilitates clear communication between Mrs. Lopez and her healthcare provider regarding financial expectations, fostering a stronger patient-provider relationship.

Potential advantages of Mrs. Lopez’s chosen plan include:

- Financial Predictability:The tiered-payment plan provides Mrs. Lopez with a clear understanding of her healthcare expenses, allowing her to budget and plan accordingly.

- Personalized Payment Schedule:Mrs. Lopez can choose the tier that best aligns with her financial situation, ensuring that payments are manageable and do not strain her budget.

- Access to Necessary Services:The cost plan provides Mrs. Lopez with access to a range of healthcare services, including those in the Basic, Standard, and Premium tiers, ensuring that she can receive the care she needs.

Potential disadvantages of Mrs. Lopez’s chosen plan include:

- Tiered Coverage:The tiered-payment plan may limit Mrs. Lopez’s access to certain healthcare services if she chooses a lower tier. This could impact her ability to receive optimal care.

- Costly Premiums:The Premium tier may have higher payment rates, which could strain Mrs. Lopez’s budget if she frequently requires services in that tier.

Cost Plan Management

Effective cost plan management is crucial for Mrs. Lopez to maximize the benefits of her enrollment. Here are some guidelines:

- Track Expenses:Mrs. Lopez should keep a record of all healthcare expenses, including payments made under the cost plan and any out-of-pocket costs.

- Stay Within Budget:Mrs. Lopez should carefully monitor her expenses to ensure that she stays within the payment schedule Artikeld in her cost plan.

- Optimize Cost Savings:Mrs. Lopez should explore ways to reduce healthcare expenses, such as negotiating discounts on medications or utilizing generic brands.

- Maximize Plan Benefits:Mrs. Lopez should take full advantage of the services and benefits covered under her cost plan to ensure that she receives the necessary care without incurring additional costs.

Cost Plan Communication

Clear communication between Mrs. Lopez and her healthcare provider is essential for a successful cost plan experience:

- Open Dialogue:Mrs. Lopez should maintain open communication with her healthcare provider regarding her financial situation and any concerns or questions she may have about her cost plan.

- Regular Reviews:Mrs. Lopez and her healthcare provider should regularly review her cost plan to ensure that it continues to meet her needs and financial capabilities.

- Effective Strategies:Mrs. Lopez can use various communication strategies to effectively convey her concerns, such as in-person meetings, phone calls, or secure messaging platforms.

Quick FAQs

What is the purpose of a cost plan?

A cost plan is a financial tool designed to help individuals manage their healthcare expenses by providing a structured framework for budgeting and tracking medical costs.

What factors may have influenced Mrs. Lopez’s decision to enroll in a cost plan?

Mrs. Lopez’s decision to enroll in a cost plan may have been influenced by factors such as rising healthcare costs, a desire to control her expenses, and the potential benefits offered by the plan, such as lower out-of-pocket costs.

What are some tips for optimizing cost savings under a cost plan?

To optimize cost savings, Mrs. Lopez can track her expenses diligently, negotiate with healthcare providers, consider generic medications, and take advantage of preventive care services.